Perhitungan Asuransi Prudential 10 Tahun

Well, I have followed this story for a month and that's good that police finally has come to some significant progress. A 32-year-old man was today arrested on suspicion of murdering Joanna Yeates. Avon and Somerset Police announced the news shortly after 8.30am. 'I would like to thank the public for their continued support for the investigation and the information they have provided to us,' said DCI Phil Jones, the senior investigating officer. 'I would also like to pay tribute to Jo's family and to Greg who continue to be unfailing in their support to me and my team at what is an incredibly difficult and painful time for them.' The arrest comes as a police source today revealed that Yeates's body could have been moved from her flat to it's dump site on Bristol's Longwoood Lane in a large suitcase or holdall, police believe.

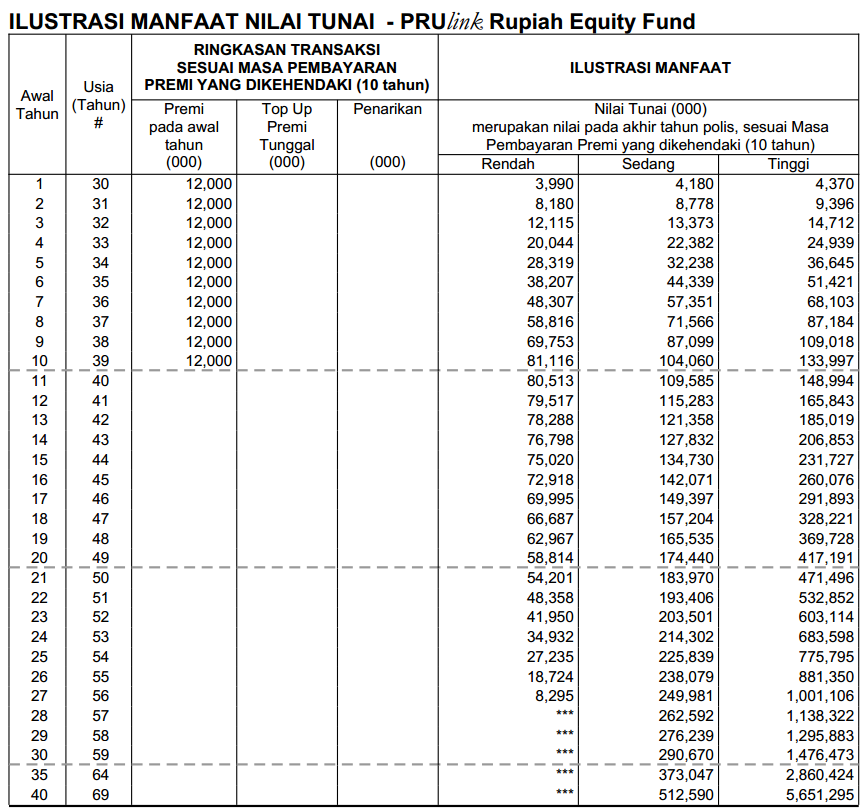

Seringkali saya menemukan nasabah-nasabah Prudential yang sudah lama menjadi nasabah tapi masih tidak mengerti atau bahkan tidak tahu bahwa produk asuransi yang mereka miliki sudah merupakan asuransi + unit link atau yang biasa kami sebut dengan produk PRUlink assurance account. Kontrak asuransi kan 10 tahun, seandainya saya tetap.

Joanna Yeates's body could have been moved from her flat to it's dump site on Bristol's Longwood Lane in a large suitcase or holdall, police believe. The theory arises from the fact that no drag marks were discovered on the strangled 25-year-old landscape architect's body or clothing, indicating it was likely carried from her flat in Clifton. The latest lead for the investigation team at Avon And Somerset Police would explain why no-one saw the body being removed during the busy Christmas period, when someone carrying or pulling a large bag would have been a commonplace sight. Pasar finansial dunia sedang dilanda krisis, baik di AS maupun seluruh dunia.

Krisis ini pun telah merambah perekonomian secara umum dan menunjukkan gejala yang makin tidak menggembirakan. Dalam jangka pendek, angka pengangguran akan meningkat, kegiatan usaha akan menurun atau bahkan macet dan topik utama pemberitaan di media massa akan terus terdengar menakutkan.

Jadi saya telah membeli saham-saham emiten AS selama periode ini. Saya berbicara tentang rekening pribadi saya, yang selama ini hanya terdiri atas obligasi pemerintah AS. Ini mengesampingkan kepemilikan saya di Berkshire Hathaway holdings, yang seluruhnya sudah didedikasikan untuk kegiatan amal dan kemanusiaan.

Apabila harga-harga saham masih atraktif, maka komposisi kekayaan saya di luar Berkshire akan segera beralih menjadi 100% saham. Mengapa demikian? Saya berpegang pada satu prinsip sederhana dalam melakukan pembelian saham: jadilah takut saat yang lain sedang tamak dan jadilah tamak saat yang lain takut.

Dan pastinya, ketakutan saat ini sedang merajalela, mencekam bahkan investor yang sudah canggih sekalipun. Memang investor berhak mengkhawatirkan perusahaan yang utangnya besar (highly-leveraged) atau bisnis yang memliki daya saing yang lemah. Tetapi ketakutan atas kejayaan perusahaan-perusahaan yang baik dalam jangka panjang adalah hal yang tidak masuk akal. Perusahaan-perusahaan ini memang akan mengalami penurunan laba, seperti biasa mereka alami di masa krisis, tetapi mereka akan mampu menciptakan rekor laba baru dalam 5, 10 atau 20 tahun dari sekarang. Perkenankan saya menjelaskan satu hal: saya TIDAK BISA memprediksi pergerakan pasar saham dalam jangka pendek. Saya sama sekali tidak punya ide apakah harga-harga saham akan menjadi lebih tinggi atau lebih rendah dalam sebulan atau setahun dari sekarang.

Jika Premi Asuransi Tidak Dibayar

Akan tetapi, yang mungkin terjadi adalah, pasar akan bergerak naik, bahkan mungkin secara signifikan, jauh sebelum sentiment atau perekonomian berbalik arah menuju perbaikan. Jadi bila anda menunggu sampai burung Robin keluar, musim semi sudah akan berlalu. Ada sebuah fakta sejarah: pada masa the Great Depression, indeks Dow Jones mencapai angka terendahnya, 41, pada tanggal 8 Juli 1932. Keadaan ekonomi, di lain pihak, terus memburuk sampai Franklin D. Roosevelt diangkat menjadi presiden AS pada Maret 1933 - pada saat itu kemudian pasar telah naik 30%. Begitu juga pada masa awal Perang Dunia Kedua, di saat keadaan memburuk bagi AS akibat perkembangan situasi di Eropa and Asia Pasifik. Pasar mencapai titik terendahnya di bulan April 1942, jauh sebelum tentara sekutu tiba.

Kemudian sekali lagi di awal 1980-an, waktu untuk membeli saham adalah saat inflasi membumbung dan perekonomian ambruk. Singkatnya, berita buruk adalah sahabat karib seorang investor karena itu memungkinkan investor membeli bagian dari masa depan AS dengan harga yang sudah terdiskon. Dalam jangka panjang, berita tentang pasar saham akan menjadi baik.

Selama abad ke-20, AS telah mengalami dua perang dunia serta berbagai konflik militer yang traumatic dan memakan biaya tinggil the Great Depression; lusinan resesi dan panic di pasar financial; gejolak harga minyak (oil shocks); wabah flu; dan pengunduran diri seorang presiden melalui pemakzulan (impeachment). Namun indeks Dow Jones tumbuh dari 66 ke 11.497! Anda mungkin berpikir bahwa mustahil bagi seorang investor untuk merugi di abad yang penuh dengan keuntungan luar biasa. Tapi beberapa investor ternyata mengalaminya dan mereka adalah investor yang membeli saham saat mereka merasa nyaman melakukannya lalu kemudian menjual saat topik utama berita membuat mereka pusing kepala. Saat ini mereka yang memegang kas merasa nyaman.

Tapi seharusnya mereka tidak karena mereka memilih asset jangka panjang yang buruk, asset yang bisa dikatakan tidak menghasilkan apa-apa dan pastinya akan terdepresiasi nilainya. Tentunya segala daya upaya pemerintah untuk mengatasi krisis mungkin malah menaikkan inflasi sehingga mempercepat penurunan nilai riil dari kas. Saham tentunya akan memberikan imbal hasil yang melebihi imbal hasil kas selama 10 tahun ke depan, dan mungkin malah jauh melebihi.Iinvestor yang terus berpegang pada kas pada dasarnya bertaruh bahwa mereka bisa beralih dari kas secara efisien di kemudian hari. Selama menunggu rasa nyaman kembali seiring dengan munculnya berita-berita baik, mereka mengacuhkan nasihat Wayne Gretzky: 'I skate to where the puck is going to be, not to where it has been.' (Saya berselancar menuju tempat di mana setan akan pergi, bukan ke mana ia pernah berada). Saya tidak mau mengutarakan pendapat tentang pasar modal, and sekali lagi saya tekankan bahwa saya tidak punya ide tentang kondisi pasar saham dalam jangka pendek.

Akan tetapi, saya akan mengikuti langkah restoran yang membuka usaha di sebuah gedung bank yang kosong: 'Put your mouth where your money was.' (“Letakkan mulutmu di mana uang berada.”) Saat ini baik uang maupun mulut saya mengatakan saham. Buffett adalah chief executive Berkshire Hathaway, sebuah perusahaan holding yang berinvestasi di berbagai bidang usaha. The financial world is a mess, both in the United States and abroad. Its problems, moreover, have been leaking into the general economy, and the leaks are now turning into a gusher.

In the near term, unemployment will rise, business activity will falter and headlines will continue to be scary. I've been buying American stocks. This is my personal account I'm talking about, in which I previously owned nothing but United States government bonds. (This description leaves aside my Berkshire Hathaway holdings, which are all committed to philanthropy.) If prices keep looking attractive, my non-Berkshire net worth will soon be 100 percent in United States equities. A simple rule dictates my buying: Be fearful when others are greedy,and be greedy when others are fearful. And most certainly, fear is now widespread, gripping even seasoned investors.

To be sure, investors are right to be wary of highly leveraged entities or businesses in weak competitive positions. But fears regarding the long-term prosperity of the nation's many sound companies make no sense. These businesses will indeed suffer earnings hiccups, as they always have. But most major companies will be setting new profit records 5, 10 and 20 years from now.

Let me be clear on one point: I can't predict the short-term movements of the stock market. I haven't the faintest idea as to whether stocks will be higher or lower a month - or a year - from now. What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up.

So if you wait for the robins, spring will be over. A little history here: During the Depression, the Dow hit its low, 41, on July 8, 1932. Economic conditions, though, kept deteriorating until Franklin D.

Roosevelt took office in March 1933. By that time, the market had already advanced 30 percent. Or think back to the early days of World War II, when things were going badly for the United States in Europe and the Pacific. The market hit bottom in April 1942, well before Allied fortunes turned. Again, in the early 1980s, the time to buy stocks was when inflation raged and the economy was in the tank.

In short, bad news is an investor's best friend. It lets you buy a slice of America's future at a marked-down price. Over the long term, the stock market news will be good.

In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497. You might think it would have been impossible for an investor to lose money during a century marked by such an extraordinary gain.

But some investors did. The hapless ones bought stocks only when they felt comfort in doing so and then proceeded to sell when the headlines made them queasy.

Today people who hold cash equivalents feel comfortable. They shouldn't.

They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value. Indeed, the policies that government will follow in its efforts to alleviate the current crisis will probably prove inflationary and therefore accelerate declines in the real value of cash accounts. Equities will almost certainly outperform cash over the next decade, probably by a substantial degree. Those investors who cling now to cash are betting they can efficiently time their move away from it later. In waiting for the comfort of good news, they are ignoring Wayne Gretzky's advice: 'I skate to where the puck is going to be, not to where it has been.' I don't like to opine on the stock market, and again I emphasize that I have no idea what the market will do in the short term.

Nevertheless, I'll follow the lead of a restaurant that opened in an empty bank building and then advertised: 'Put your mouth where your money was.' Today my money and my mouth both say equities. Buffett is the chief executive of Berkshire Hathaway, a diversified holding company. Saya copy paste informasi dari Priyadi.net soal ruginya berinvestasi via unit link. Pak Priyadi bukan asal omong.

Memang kenyataanya merugikan. Saya sudah buktikan karena mengikuti asuransi terebut sejak Oktober 2009. Premi yang aya bayarakan perbulan RP 750 ribu dan saat tulisan ini dibuat sudah 15 kali pembayaran, yang berarti total uang yang sudah saya setor adalah Rp 11.250.000.

Tahukah, berapa total uang saya sekarang di unit link prudential, jauh lebih kecil dari nlai yang sudah saya setor selama 15 bulan terakhir. Prudential benar-benar merugikan. Banyak biaya siluman yang saya tidak pahami.

Hitungannya tidak transparan. Oleh karena itu, untuk teman, saya sarankan baca blog priyadi.net, jangan sampai menyesal mengikuti Prulink Prudential.Ini link untuk artike soal betapa unit link itu merugikan:beberapa tahun yang lalu, di Indonesia mulai marak dipasarkan produk-produk asuransi unit link. Unit link adalah produk asuransi yang menggabungkan layanan asuransi dan investasi sekaligus. Dengan menjadi nasabah produk unit link, seseorang bisa mendapatkan manfaat ganda yaitu perlindungan asuransi dan investasi. Produk asuransi yang ditawarkan bisa berbentuk asuransi kesehatan atau asuransi jiwa, tetapi biasanya dipasarkan dalam kemasan yang lebih menarik bagi masyarakat: misalnya tabungan masa depan atau asuransi pendidikan.Seperti halnya asuransi biasa, nasabah asuransi unit link membayar premi setiap jangka waktu tertentu, biasanya bulanan. Perbedaannya, nasabah unit link membayar premi dalam dua porsi: porsi premi perlindungan dan porsi investasi. Premi perlindungan berfungsi sama dengan premi pada asuransi biasa.

Sedangkan porsi investasi akan disetorkan oleh perusahaan asuransi kepada manajer investasi untuk dikelola. Pada produk-produk tertentu, jika nantinya return dari investasi bisa menutupi biaya premi, maka nasabah memiliki pilihan untuk tidak membayar premi.Sebagian besar perusahaan-perusahaan jasa manajer investasi ini biasanya memiliki produk reksadana retail yang ditawarkan ke masyarakat. Ini yang membuat saya berpikir keuntungan dan kerugian mengikuti layanan asuransi dan reksadana secara terpisah, ketimbang mengikuti layanan unit link yang menggabungkan kedua jenis layanan tersebut.Menjadi nasabah investasi unit link dan reksadana sebenarnya tidak jauh berbeda. Dalam keduanya, nasabah diminta untuk memilih kemana dana yang disetorkan akan diinvestasikan. Pilihan yang disediakan adalah ekuitas, fixed income, pasar uang atau kombinasi di antaranya. Keduanya sama-sama memiliki resiko yang kurang lebih sama, tergantung dari jenis investasi yang dipilih.

Tetapi tentunya bukannya tidak ada perbedaan sama sekali.Besar Biaya AkuisisiBiasanya, asuransi unit link dipasarkan secara sangat agresif, tidak jarang menggunakan sistem pemasaran langsung. Di sisi lain, manager investasi minim melakukan pemasaran. Pemasaran yang agresif bisa menjaring lebih banyak nasabah, tetapi biaya akuisisi akan semakin tinggi dan biaya ini tetap akan dibebankan kepada nasabah.Sebagai contoh, salah satu produk asuransi link unit membebankan biaya akuisisi kepada nasabah sebesar 41% dari setoran porsi premi asuransi untuk lima tahun pertama.

Biaya ini kemudian akan ditalangi dengan tidak memberikan sebagian manfaat asuransi pada tahun pertama dan sisanya kemudian dibebankan pada setoran porsi investasi.TransparansiReksadana biasanya jauh lebih transparan daripada produk investasi yang ada dalam unit link. Biasanya, nasabah reksadana dapat dengan mudah mengetahui informasi-informasi seperti sejarah perkembangan investasi, resiko, alokasi aset, biaya jasa pengelolaan dan sebagainya. Sedangkan dalam unit link, seringkali sulit untuk mendapatkan informasi-informasi yang berhubungan dengan manajer investasi beserta biaya dan kinerjanya.

Kebanyakan agen asuransi biasanya lebih banyak berkutat pada ilustrasi yang abstrak tanpa dengan jelas memberi tahu parameter-parameter pembentuk ilustrasi tersebut. Terlebih lagi, calon nasabah yang awam tidak memiliki pembanding yang cukup untuk menilai kualitas yang diberikan oleh ilustrasi tersebut.Pada produk unit link ada lebih banyak variabel yang berperan. Hal ini menjadikan ilustrasi yang diberikan oleh penyedia layanan asuransi menjadi sangat rumit, terutama bagi calon nasabah yang belum mengenal asuransi dan/atau reksadana.

Jika calon nasabah tidak cukup jeli dalam menganalisis ilustrasi yang diberikan, bukan tidak mungkin akan ada biaya-biaya siluman yang tidak disadari oleh calon nasabah. Tidak jarang, biaya-biaya ini baru diketahui nasabah pertama kali dari polis yang didapatkan, atau bahkan ketika biaya tersebut dibebankan kepada nasabah.Pada unit link, akan menjadi sangat sulit bagi calon nasabah untuk membandingkan satu layanan asuransi unit link dengan layanan unit link lainnya karena sistem yang digunakan bisa jadi jauh berbeda.

Membandingkan dua atau lebih layanan asuransi biasa sudah cukup rumit tanpa harus dicekcoki dengan berbagai macam urusan investasi yang nyatanya tidak benar-benar terpisah dengan asuransi.Dengan memisahkan asuransi dan reksadana, perhitungan yang perlu dilakukan oleh nasabah akan menjadi jauh lebih transparan dan sederhana.Perhitungan Inflasi pada Jumlah PertanggunganBeberapa produk unit link memberi fitur utama yaitu janji putus pembayaran premi setelah tahun tertentu, yang tergantung pada perkembangan investasi. Yang jarang diperhatikan oleh nasabah adalah faktor inflasi yang akan memaksa nasabah untuk menambah jumlah premi yang harus dibayarkan di masa yang akan datang. Tentunya hal ini berlaku pula pada asuransi biasa, akan tetapi pada asuransi biasa, calon nasabah tidak pernah dijanjikan putus pembayaran premi.Contoh: Seseorang mengikuti asuransi PRIlink dengan porsi premi asuransi kesehatan sebesar Rp 50000 per bulan dengan jumlah pertanggungan untuk perawatan di rumah sakit sebesar Rp 500000/hari. Setelah 10 tahun, diprediksi return investasi dapat menutupi pembayaran premi tersebut. Tetapi hal ini belum memperhitungkan inflasi yang akan terjadi sampai 10 tahun ke depan. Inflasi akan menyebabkan biaya perawatan di rumah sakit menjadi semakin tinggi. Untuk mendapatkan perawatan di rumah sakit yang setara dengan Rp 500000/hari saat ini, 10 tahun kemudian kita harus membayar lebih besar daripada jumlah tersebut.

Akibatnya premi akan semakin besar dan putus pembayaran premi menjadi tertunda atau bahkan tidak akan pernah terjadi.Sebagai catatan, dengan asumsi inflasi tahunan sebesar 7,5% per tahun dan biaya perawatan sebanding dengan laju inflasi, maka untuk mendapatkan kualitas perawatan seharga Rp 500 ribu/hari pada hari ini, dalam 10 tahun kita harus membayar biaya perawatan sebesar kurang lebih Rp 1 juta/hari. Dengan memperhatikan inflasi, rencana putus pembayaran premi pasti akan mundur atau bahkan tidak akan terjadi, tergantung porsi investasi yang ditetapkan dan realisasi perkembangan investasi.Selain itu, putus pembayaran premi bukanlah fitur spesifik unit link. Nasabah asuransi dan reksadana secara terpisah juga dapat menikmati fasilitas ini karena pembayaran premi asuransi bisa saja nantinya dibebankan pada return investasi di masa yang akan datang.

Perbedaannya, pada nasabah asuransi dan reksadana terpisah, dana tersebut harus melewati kantong nasabah yang bersangkutan. Sedangkan pada unit link semuanya telah diurus oleh pihak penyedia layanan asuransi.Panjang Jalur AdministrasiPada investasi unit link, instruksi nasabah perlu melewati beberapa pihak: dari agen asuransi (jika ada), ke perusahaan asuransi, dan baru kemudian mencapai manager investasi untuk diproses. Semakin panjang rantai instruksi ini tentunya semakin lama instruksi tersebut dapat diproses. Panjang administrasi ini dapat diputus dengan mengalokasikan dana investasi langsung ke produk reksadana yang dikeluarkan oleh manajer investasi, tanpa melewati perusahaan asuransi.Selain itu, semakin panjang jalur administrasi tentunya juga semakin banyak biaya administrasi yang perlu dikeluarkan oleh seorang nasabah.

Dengan menempuh jalan pintas dengan cara melakukan investasi pada reksadana secara langsung, nasabah dapat mempercepat instruksi dan sekaligus menghemat biaya-biaya administrasi.Walaupun reksadana adalah instrumen investasi jangka panjang, kecepatan pemrosesan instruksi adalah faktor yang cukup kritis. Pada kebanyakan (semua?) produk reksadana, instruksi nasabah dilakukan atas harga yang berlaku pada penutupan hari tersebut. Sedangkan dari informasi beberapa agen produk unit link, saya tidak sepenuhnya yakin bahwa instruksi nasabah dilakukan berdasarkan harga yang berlaku pada penutupan hari tersebut. Bisa saja instruksi yang dilakukan pada hari H baru akan dilakukan pada H+2, pada saat harga unit link sudah berbeda.Keterikatan dan FleksibilitasYang paling penting bagi yang serius untuk menjalankan investasi adalah faktor keterikatan.

Dengan memisahkan layanan asuransi dan reksadana, kita bisa membagi proporsi di antara keduanya sesuai dengan situasi dan kondisi kita pada saat itu, tanpa harus terikat dengan proporsi dan jumlah yang telah ditetapkan dalam polis asuransi. Jika sedang membutuhkan uang, kita bisa tetap membayar premi asuransi, tetapi bisa bebas berhenti menyetorkan dana investasi tanpa harus takut kehilangan manfaat asuransi. Sebaliknya, jika sedang memiliki dana berlebih, kita bisa menyetorkan kelebihan dana tersebut ke reksadana tanpa harus terkena penalti atau biaya tambahan.Selain itu, kita juga bisa dengan bebas memindahkan dana dari satu manajer investasi ke manajer investasi lainnya sesuai keperluan; atau bahkan memindahkan dana dari reksadana ke instrumen investasi non reksadana tanpa harus terkena penalti sisa dana minimum. Semua ini akan bisa dilakukan tanpa keterikatan dengan penyedia layanan asuransi.Dengan demikian saya tidak dapat melihat adanya nilai tambah yang diberikan unit link dibandingkan dengan mengikuti asuransi dan reksadana secara terpisah. Kelebihan unit link hanya ada bagi orang-orang yang belum mengetahui keberadaan reksadana sebagai instrumen investasi. Kelebihan unit link lainnya adalah kepraktisan bagi yang tidak ingin berhubungan dengan pihak yang berbeda untuk mengurusi investasi dan asuransi.

Mengingat mendaftar reksadana tidak lebih sulit daripada mendaftar akun tabungan bank, saya tidak yakin manfaat kepraktisan yang didapatkan akan sebanding dengan biaya yang dikeluarkan.Pada beberapa tahun yang lalu, saat jumlah minimum setoran pada produk reksadana mencapai puluhan juta rupiah (yang saya tahu), mungkin unit link bisa bermanfaat bagi yang ingin melakukan investasi kecil secara periodik (menyisihkan sebagian gaji bulanan untuk keperluan investasi). Tetapi pada kondisi saat ini dimana jumlah setoran minimum reksadana bisa mencapai sekurang-kurangnya Rp 100 ribu, bagi saya unit link praktis tidak lagi begitu menarik.Tambahan: silakan baca untuk melihat perbandingan perhitungan secara kuantitatif. Grim toll: Workers at the cemetery in Teresopolis, near Rio, have dug dozens of graves for landslide victimsThe mayor of Teres贸polis, Jorge Mario Sedlacek, said that more than 2,000 tents were being brought in, each capable of sheltering up to 10 people.' They will give families shelter for up to six months while more permanent solutions can be developed,' Mr Sedlacek said.' These tents will at least re-establish the family units, which will bring some comfort to people living in communal shelters.'

Grounded: Rescue workers were forced to return to their helicopter as the rains came down again, making it hard to search for mudslide victimsThat could come as good news to people like Magda Brito Silveira, who said she was near her breaking point trying to run her family of six children after five chaotic days in a crowded gymnasium-turned-shelter.' We have nowhere else to go, no resources,' she said. 'I am trying to keep the children clean, to feed them, to make sure we're all together. But I can't hold on like this much longer.' A local business has offered land on which to set up the tents, and crews began working to level the ground, Mr Sedlacek said. Can It be worth paying the extra for a pint of organic milk?

The difference may be only nine pence, but an average family drinks 12 or so pints a week. In a year, that adds up to £56. So, over the time your children live at home you could pay for a holiday or two simply by sticking to ordinary milk. No one will notice the difference in their bowl or glass. Though green fanatics insist they prefer the taste of organic milk, formal tests have shown that there’s very little to choose between them on the palate. Try both milks on a bowl of cornflakes and you’re unlikely to be able to tell them apart.But there are other reasons to pay the extra.

This week, important new research was published by Newcastle University showing that organic milk contains less unhealthy fat, as well as a range of important healthy nutrients. Organically-farmed dairy cows are fed mainly on that old-fashioned substance, grass.The organic movement has a further list of other claims for organic: it’s not just about your health and that of the environment, but also about cows’ welfare, rural jobs and the very shape of the traditional British countryside. That’s what the nine pence pint is subsidising.Are these claims true? On human health, there has been a long and acrimonious debate in the dairy industry and government over the advantages of organic milk. But that came closer to settlement this week, with the latest piece of research to confirm distinct nutritional benefits. Mass production: Factory production techniques result in cows being fed an unnatural diet in an unnatural environmentPesticides are banned in organic farming, and artificial fertiliser is not necessary because plants such as clover are grown that help enrich the soil.

Use of antibiotics to treat cows is controlled — but they are less likely to be used because living conditions for organic cows are less crowded.Conventionally-farmed cows may suffer diseases of the feet from standing indoors in excrement. They may be kept in cubicles, leading to stress and injury. And the cows, producing ten times the milk they would do naturally, get ill and have very short lives. A meal in a glass: Regardless of where your pint comes from, milk contains a host of vitamins and mineralsPhil Stocker of the organic overseeing body, the Soil Association, points out that the huge amounts of slurry — excrement — produced by large-scale conventional dairy farms is a nasty hazard as it can end up penetrating the water table. Just last week a Devon dairy farmer was fined £1,500 because slurry from his farm had contaminated an important salmon river.The Soil Association stipulates that organically-farmed cows must graze on pasture in the spring and summer. They do live something a little closer to the life of Daisy the Dairy Cow you might recognise from picture books.For a start they live longer. The Holsteins and Friesians cross-bred especially for industrial dairy are five times as productive as the ancient breeds, but they are exhausted often before they’ve had just two or three calves, at about four or five years old.

Traditional hardy British breeds such as Ayrshire and the Jersey and Guernsey may produce calves and give milk for 12 years.DairY farming has been in decline, with more than one farmer going out of business every day according to the National Farmers Union. Supermarkets are blamed for increasing their share of the price of each pint, while keeping prices among the lowest in Europe. More.‘Over the past decade an awful lot of dairy farmers have faced a choice — go industrial to lower costs, or specialise in organic farming,’ says Phil Stocker, himself a farmer.‘These farms tend to be smaller and family run. They employ more people per cow. Organic farming has helped preserve a regional network of these traditional farms.

Without them, we’ll only see more factory farms like Nocton the proposed 3,700-cow mega-dairy planned in Linconshire.’Historians point to the role of small-scale dairy in shaping Britain — providing jobs in rural communities, and with structures from dairy sheds to hedges and stone field walls giving the countryside the shape we treasure.So the verdict seems to be — spend 9p extra a pint and save Daisy the Dairy Cow, in her straw hat. But even the switch to organic cannot bring back the milkmaid and her three-legged stool. Have you noticed that Lockheed Martin, the giant weapons corporation, is shadowing you? Then you haven't been paying much attention. Let me put it this way: If you have a life, Lockheed Martin is likely a part of it.

True, Lockheed Martin doesn't actually run the U.S. Government, but sometimes it seems as if it might as well. After all, it received $36 billion in government contracts in 2008 alone, more than any company in history.

It now does work for more than two dozen government agencies from the Department of Defense and the Department of Energy to the Department of Agriculture and the Environmental Protection Agency. It's involved in surveillance and information processing for the CIA, the FBI, the Internal Revenue Service (IRS), the National Security Agency (NSA), the Pentagon, the Census Bureau, and the Postal Service. Oh, and Lockheed Martin has even helped train those friendly Transportation Security Administration agents who pat you down at the airport. Naturally, the company produces cluster bombs, designs nuclear weapons, and makes theF-35 Lightning (an overpriced, behind-schedule, underperforming combat aircraft that is slated to be bought by customers in more than a dozen countries) - and when it comes to weaponry, that's just the start of a long list. In recent times, though, it's moved beyond anything usually associated with a weapons corporation and has been virtually running its own foreign policy, doing everything from hiring interrogators for U.S. Overseas prisons (including at Guantanamo Bay in Cuba and Abu Ghraib in Iraq) to managing a private intelligence network in Pakistan and helping write the Afghan constitution.

A For-Profit Government-in-the-Making If you want to feel a tad more intimidated, consider Lockheed Martin's sheer size for a moment. After all, the company receives one of every 14 dollars doled out by the Pentagon.

In fact, its government contracts, thought about another way, amount to a “Lockheed Martin tax” of $260 per taxpaying household in the United States, and no weapons contractor has more power or money to wield to defend its turf. It spent $12 million on congressional lobbying and campaign contributions in 2009 alone.

Not surprisingly, it's the top contributor to the incoming House Armed Services Committee chairman, Republican Howard P. “Buck” McKeon of California, giving more than $50,000 in the most recent election cycle. It also tops the list of donors to Sen. Daniel Inouye (D-HI), the powerful chair of the Senate Appropriations Committee, and the self-described “#1 earmarks guy in the U.S.

Congress.” Add to all that its 140,000 employees and its claim to have facilities in 46 states, and the scale of its clout starts to become clearer. While the bulk of its influence-peddling activities may be perfectly legal, the company also has quite a track record when it comes to law-breaking: it ranks number one on the “contractor misconduct” database maintained by the Project on Government Oversight, a Washington-DC-based watchdog group. How in the world did Lockheed Martin become more than just a military contractor? Its first significant foray outside the world of weaponry came in the early 1990s when plain old Lockheed (not yet merged with Martin Marietta) bought Datacom Inc., a company specializing in providing services for state and city governments, and turned it into the foundation for a new business unit called Lockheed Information Management Services (IMS). In turn, IMS managed to win contracts in 44 states and several foreign countries for tasks ranging from collecting parking fines and tolls to tracking down “deadbeat dads” and running “welfare to work” job-training programs. The result was a number of high profile failures, but hey, you can't do everything right, can you? Under pressure from Wall Street to concentrate on its core business - implements of destruction - Lockheed Martin sold IMS in 2001.

By then, however, it had developed a taste for non-weapons work, especially when it came to data collection and processing. So it turned to the federal government where it promptly racked up deals with the IRS, the Census Bureau, and the U.S.

Postal Service, among other agencies. As a result, Lockheed Martin is now involved in nearly every interaction you have with the government. Paying your taxes? Lockheed Martin is all over it.

The company is even creating a system that provides comprehensive data on every contact taxpayers have with the IRS from phone calls to face-to-face meetings. Want to stand up and be counted by the U.S. Lockheed Martin will take care of it. The company runs three centers - in Baltimore, Phoenix, and Jeffersonville, Indiana - that processed up to 18 tractor-trailers full of mail per day at the height of the 2010 Census count. For $500 million it is developing the Decennial Response Information Service (DRIS), which will collect and analyze information gathered from any source, from phone calls or the Internet to personal visits. According to Preston Waite, associate director of the Census, the DRIS will be a “big catch net, catching all the data that comes in no matter where it comes from.” Need to get a package across the country?

Lockheed Martin cameras will scan bar codes and recognize addresses, so your package can be sorted “without human intervention,” as the company's web site puts it. Plan on committing a crime? Lockheed Martin is in charge of the FBI's Integrated Automatic Fingerprint Identification System (IAFIS), a database of 55 million sets of fingerprints. The company also produces biometric identification devices that will know who you are by scanning your iris, recognizing your face, or coming up with novel ways of collecting your fingerprints or DNA. As the company likes to say, it's in the business of making everyone's lives (and so personal data) an “open book,” which is, of course, of great benefit to us all. “Thanks to biometric technology,” the company proclaims, “people don't have to worry about forgetting a password or bringing multiple forms of identification.

Things just got a little easier.” Are you a New York City resident concerned about a “suspicious package” finding its way onto the subway platform? Lockheed Martin tried to do something about that, too, thanks to a contract from the city's Metropolitan Transportation Authority (MTA) to install 3,000 security cameras and motion sensors that would spot such packages, as well as the people carrying them, and notify the authorities.

Only problem: the cameras didn't work as advertised and the MTA axed Lockheed Martin and cancelled the $212 million contract. Collecting Intelligence on You If it seems a little creepy to you that the same company making ballistic missiles is also processing your taxes, accessing your fingerprints, scanning your packages, ensuring that it's easier than ever to collect your DNA, and counting you for the census, rest assured: Lockheed Martin's interest in getting inside your private life via intelligence collection and surveillance has remained remarkably undiminished in the twenty-first century. Tim Shorrock, author of the seminal book Spies for Hire, has described Lockheed Martin as “the largest defense contractor and private intelligence force in the world.” As far back as 2002, the company plunged into the “Total Information Awareness” (TIA) program that was former National Security Advisor Admiral John Poindexter's pet project. A giant database to collect telephone numbers, credit cards, and reams of other personal data from U.S. Citizens in the name of fighting terrorism, the program was de-funded by Congress the following year, but concerns remain that the National Security Agency is now running a similar secret program.

In the meantime, since at least 2004, Lockheed Martin has been involved in the Pentagon's Counterintelligence Field Activity (CIFA), which collected personal data on American citizens for storage in a database known as “Threat and Local Observation Notice” (and far more dramatically by the acronym TALON). While Congress shut down the domestic spying aspect of the program in 2007 (assuming, that is, that the Pentagon followed orders), CIFA itself continues to operate. In 2005, Washington Post military and intelligence expert William Arkin revealed that, while the database was theoretically being used to track anyone suspected of terrorism, drug trafficking, or espionage, “some military gumshoe or overzealous commander just has to decide someone is a 'threat to the military'” for it to be brought into play. Among the “threatening” citizens actually tracked by CIFA were members of antiwar groups. As part of its role in CIFA, Lockheed Martin was not only monitoring intelligence, but also “estimating future threats.” (Not exactly inconvenient for a giant weapons outfit that might see antiwar activism as a threat!) Lockheed Martin is also intimately bound up in the workings of the National Security Agency, America's largest spy outfit. In addition to producing spy satellites for the NSA, the company is in charge of “Project Groundbreaker,” a $5 billion, 10-year effort to upgrade the agency's internal telephone and computer networks.

While Lockheed Martin may well be watching you at home - it's my personal nominee for twenty-first-century “Big Brother” - it has also been involved in questionable activities abroad that go well beyond supplying weapons to regions in conflict. There were, of course, those interrogators it recruited for America's offshore prison system from Guantanamo Bay to Afghanistan (and the charges of abuses that so naturally went with them), but the real scandal the company has been embroiled in involves overseeing an assassination program in Pakistan.

Initially, it was billed as an information gathering operation using private companies to generate data the CIA and other U.S. Intelligence agencies allegedly could not get on their own.

Instead, the companies turned out to be supplying targeting information used by U.S. Army Special Forces troops to locate and kill suspected Taliban leaders. The private firms involved were managed by Lockheed Martin under a $22 million contract from the U.S. As Mark Mazetti of the New York Times has reported, there were just two small problems with the effort: “The American military is largely prohibited from operating in Pakistan. And under Pentagon rules, the army is not allowed to hire contractors for spying.” Much as in the Iran/Contra scandal of the 1980s, when Oliver North set up a network of shell companies to evade the laws against arming right-wing paramilitaries in Nicaragua, the Army used Lockheed Martin to do an end run around rules limiting U.S. Military and intelligence activities in Pakistan. It should not, then, be too surprising that one of the people involved in the Lockheed-Martin-managed network was Duane “Dewey” Claridge, an ex-CIA man who had once been knee deep in the Iran/Contra affair.

A Twenty-First Century Big Brother There has also been a softer side to Lockheed Martin's foreign policy efforts. It has involved contracts for services that range from recruiting election monitors for Bosnia and the Ukraine and attempting to reform Liberia's justice system to providing personnel involved in drafting the Afghan constitution. Most of these projects have been carried out by the company's PAE unit, the successor to a formerly independent firm, Pacific Architects and Engineers, that made its fortune building and maintaining military bases during the Vietnam War. However, the “soft power” side of Lockheed Martin's operations (as described on its web site) may soon diminish substantially as the company has put PAE up for sale.

Still, the revenues garnered from these activities will undoubtedly be more than offset by a new $5 billion, multi-year contract awarded by the U.S. Army to provide logistics support for U.S. Special Forces in dozens of countries. Consider all this but a Lockheed Martin pr茅cis. A full accounting of its “shadow government” would fill volumes.

After all, it's the number-one contractor not only for the Pentagon, but also for the Department of Energy. It ranks number two for the Department of State, number three for the National Aeronautics and Space Administration, and number four for the Departments of Justice and Housing and Urban Development. I was just reading an article about the poor and the rich suburbs in Australia. And my eyes are rolling over the income of the poorest suburb in Australia, which is Callaghan in NSW. This suburb's average income is $27,388 a year.

Well, after calculating, my income is less than that of Callaghan's people. Whoa.the wide gap between develop and developing countries is really real. Gosh.if I am in Australia, with my current job, I would get far much higher than I earn now. Anyway, that is life that most people here have to face in their daily situation.Btw, if you ask why I firstly look into the income of the people in the poor suburbs, here is the answer. I would not look at the richest suburb because it is beyond most of the people's income here.

Even comparing to the average income in the poorest suburb of Australia, most people here still earn far less than their counter part in Australia. THE Sydney suburb of Edgecliff and surrounding area is the nation's richest with an average income of more than $186,000 a year. That's more than $20,000 ahead of Toorak in Victoria, which is Australia's second wealthiest suburb with a mean income of more than $165,000. Victoria's Portsea is the third richest, with an average income of just over $160,000 but down nearly 30 per cent on the previous tax year. Portsea topped the nation's wealthiest suburbs in 2006-07 with an average income of $219,345. Tax office data released yesterday revealed the country's wealthiest and poorest areas for the 2007-08 tax year, as well as how much tax we're paying and how much we're deducting. The data also provides an insight into the disparity between the nation’s richest and poorest workers.

The residents of Sydney’s 2027 postcode – which include Westfield's Frank Lowy with an estimated worth of $4.2 billion - earn $159,000 more than the country’s poorest area, which the ATO names as Callaghan. Start of sidebar. Skip to end of sidebar. Home loans, savings accounts and more Callaghan is the area covering the student halls of residence at NSW's University of Newcastle. The average income is just over $27,000.

State breakdown Western Australia’s Peppermint Grove and Cottesloe tops the mining state with $130,057. In Queensland, Ascot and Hamilton top their state with an average income of $101,000. While QLD, WA, New South Wales and Victoria's richest have an average income of more than $100,000, South Australia’s wealthiest suburb, North Adelaide, has an average of $84,790. The Northern Territory's 880 postcode, which includes the suburbs of Gapuwiyak, Gove, Gunyangara, Nhulunbuy and Yirrkala, is the state’s best earner with an average of $76, 427. In the ACT, the suburbs of Forrest, Griffith, Manuka and Red Hill claim the top spot with an average income of $91,209. Tasmania's 7005 postcode, capturing the suburbs of Dynnyrne, Lower Sandy Bay and the University of Tasmania is the state's wealthiest with an average income of $65,174.

Analysing the nation’s tax returns, the data revealed Australian workers paid more than $583 billion in tax in 2007-08, an increase of more than 9 per cent on the previous year. And an additional 840,000 people lodged tax returns, with workers eager to grab a slice of Kevin Rudd’s stimulus package which paid a $900 cash bonus to those earning under $80,000. The Australian reported while the number of people filing returns rose 7.1 per cent, the total value of tax deductions claimed leapt 19.1 per cent.

THEY'RE often unfairly stereotyped, the subject of countless studies, and in many ways they're better placed than most Australians to achieve a bright financial future. Generation Y those born between 1982 and 2000 can be well into their 20s. Some are looking to consolidate a career, settle down, buy or pay off a home, perhaps start a family.

Others are still in party mode that may last into their 30s. Some have already collected a nasty pile of consumer debt, and investing and superannuation are the last thing on their minds. After all, retirement is more than 30 or 40 years away. However, such a long time frame gives Generation Y a great opportunity to bring their finances under control, use the superannuation system to their advantage and start a savings and investment plan that can eventually make them richer than their parents. PROFESSIONAL university students are racking up massive debts of nearly $400,000 for 'lifetime' tuition. As the cost of the university loans scheme balloons out to more than $20 billion, scores of students are avoiding repaying their debts by staying out of the workforce. Australia's most expensive university student has amassed an astonishing $384,957 debt - enough to buy an inner-city apartment or fund more than six undergraduate degrees in medicine or dentistry.

And confidential Freedom of Information documents reveal other 'professional' students have accrued debts between $264,677 and $175,805 - leading to claims they are clogging up campuses and have no intention of repaying taxpayers. In total, 20 students racked up loan debts of $161,162 or more. Education experts want the Gillard Government to 'cap' the size of university loans to stop students going from one university degree to another. Home loans, savings accounts and more Australia's student loans scheme started in 1989. The system has been costly with $4 billion in student loans 'written off' while a further $400 to $500 million are listed as 'doubtful' debts.

Some students have been at university for more than 15 years, and education experts called on the Government to tighten up the loans scheme to prevent debt blow-outs. 'It's not the responsibility of taxpayers to underwrite the lifestyle of professional students who want to spend the bulk of their adult life swanning around university campus,' Institute of Public Affairs' research fellow Tony Barry said. Higher Education Minister Chris Evans backed the loans scheme: 'Without HECS or HELP, governments would need to substantially increase taxes to provide the support to universities to deliver high-quality education.' THE western Victorian town of Horsham is facing the prospect of a one-in-200-year flood event when the swollen Wimmera River peaks later this morning. Thousands are facing a massive clean-up after floods in many towns peaked overnight. Thousands are facing a massive clean-up after floods in many towns peaked overnight.

Horsham is facing a one-in-200-year flood event when the swollen Wimmera River peaks later today. Floodwater in Echuca, on the Murray River, peaked overnight. More than 2000 people in Victoria have been evacuated as flash flooding wreaks havoc across the state. The SES is relieved as waters recede in Beaufort after floods swept through the Victorian town Thousands are facing a massive clean-up after floods in many towns peaked overnight. The bad news for Horsham comes as residents of Echuca begin to assess the damage after the Campaspe River's peak at about 11pm (AEDT) last night, which affected 170 properties and forced the evacuation of 170 people. 'This could be a one-in-200-year flood event. That's the worst case scenario but it could happen,' State Emergency Service (SES) spokeswoman Natasha Duckett said.

'The Wimmera River is higher than the levels seen in September 2010 and it's still rising. They have had 130mm in the river over a three-day period.